Have you ever typed "is coi leray asian" into a search bar, perhaps wondering about an artist's background, or maybe you saw "COI" somewhere and felt a little unsure what it meant? It's a really common thing, you know, for words or phrases to sound alike but mean something completely different. In this instance, "Coi Leray" is a well-known musical artist, but "COI" is actually an important business document. We're here to talk about that second one, the "COI," or Certificate of Insurance, and why it's a big deal for many people and businesses. It's truly a foundational piece of paper in the business world, so it's worth getting to know.

It seems a lot of people are curious about this term, "COI," and what it actually stands for. While the phrase "is coi leray asian" might bring up thoughts of a celebrity, the acronym "COI" holds a very specific and practical meaning in the world of business and agreements. It's essentially a quick way to show someone that you have insurance coverage. This document, a Certificate of Insurance, acts as a sort of snapshot, giving key details about an active insurance policy without needing to share the whole lengthy policy document. It’s pretty useful, you know, for quick checks.

Knowing what a COI is, and why it matters, can really help you out, whether you run a small company or work with various contractors. It's a way to protect yourself and your business from unexpected problems that might come up. This simple piece of paper, a Certificate of Insurance, can save a lot of headaches and keep things running smoothly. So, let's explore what this document is all about, and why it's something you should probably know about. It's honestly a bit of a quiet hero in many business dealings.

Table of Contents

- What is a Certificate of Insurance (COI)?

- Why is a COI Important?

- Who Needs a COI?

- Getting a COI

- Key Details on a COI

- COI and Risk Mitigation

- COI in Business Transactions

- Frequently Asked Questions About COIs

What is a Certificate of Insurance (COI)?

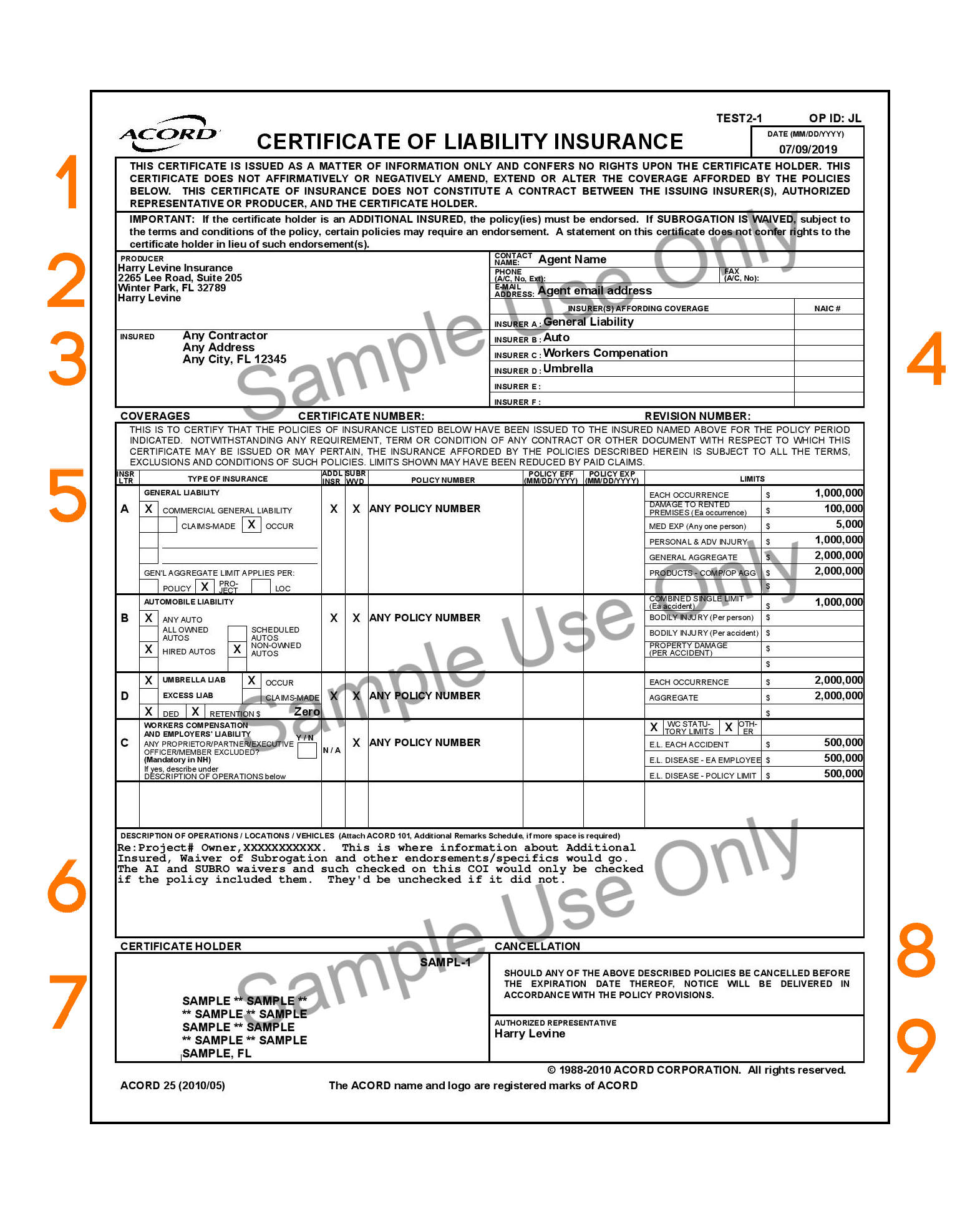

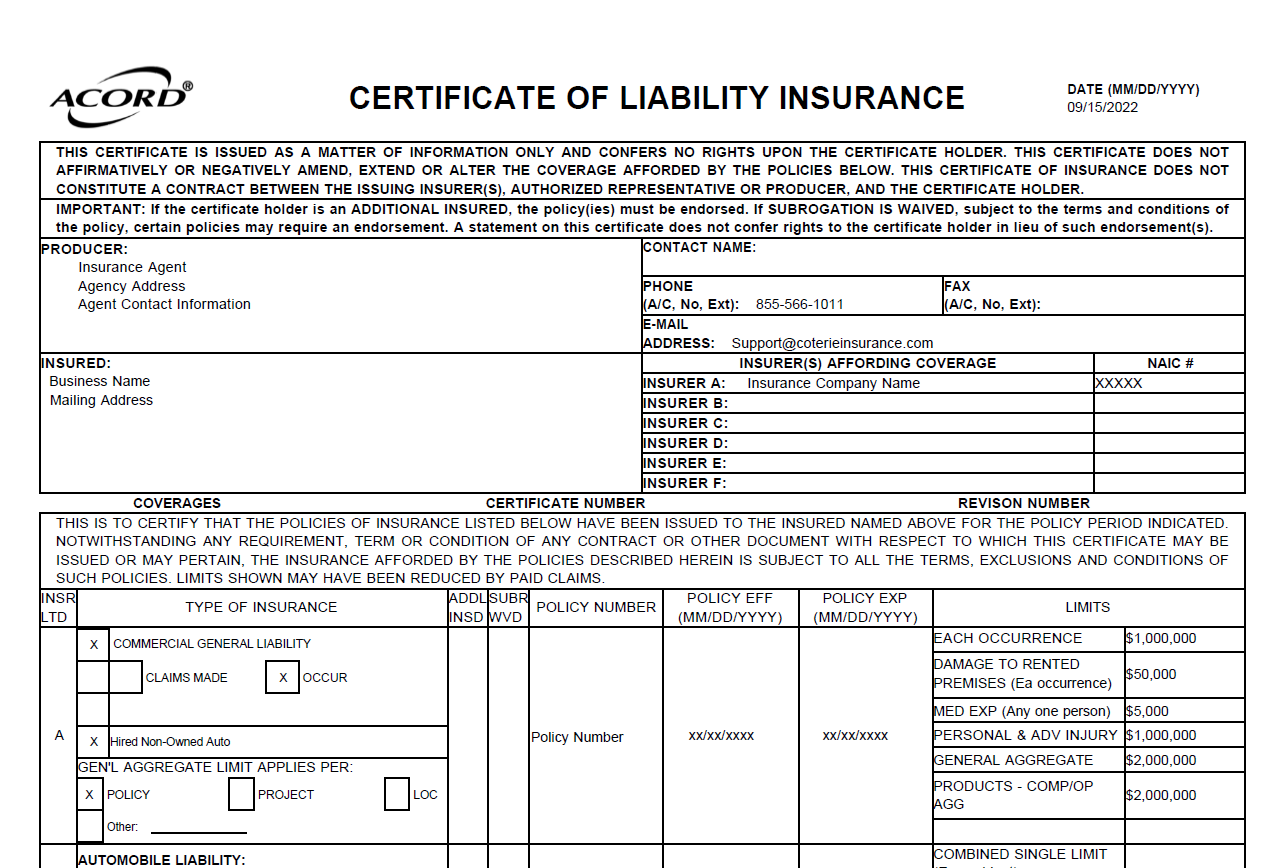

A Certificate of Insurance, often called a COI, is a nonnegotiable document. It's issued by an insurance company or a broker, basically verifying that an insurance policy actually exists. It's not the policy itself, but more like a brief summary. You see, it confirms that someone has valid insurance coverage, which is pretty handy. This paper, you know, shows that the policy is active and in force.

It's also known as a certificate of liability insurance or simply proof of insurance. Think of it as a quick, official note from your insurer. This note says, "Yes, this person or business has coverage." It’s a document that shows you have business insurance, which is very helpful for many situations. So, it's not a full policy, but it does confirm the presence of one.

A COI is a coverage summary issued by your insurer. It provides proof of insurance coverage, and that's its main job. This document from an insurer shows you have business insurance. It's commonly used in business transactions and contracts to confirm that an entity has coverage. This helps build trust and, you know, it helps reduce potential problems later on.

It's a critical document in business operations. It serves as proof that an entity holds valid insurance coverage. This document, a COI, confirms that the vendor has adequate coverage. This protects your business from unexpected liabilities. Requesting a COI isn’t just about being careful, it's about being prepared.

Why is a COI Important?

Proof of insurance is essential for small businesses and contractors. It helps prevent risk and liability. A COI helps ensure trust and it mitigates potential issues. When you're working with others, knowing they have insurance can make a big difference. It's a simple way to show responsibility, really.

A COI helps protect your business from unexpected liabilities. It means that if something goes wrong, and it's related to the work being done, there's a policy in place to handle it. This is very important for peace of mind, you know, for everyone involved. It shows a commitment to managing potential problems.

It's a document that provides proof of insurance. This is incredibly useful for business transactions. It confirms that an individual or business has the necessary coverage. This helps keep things fair and transparent. So, it's not just a piece of paper; it's a tool for better business dealings.

The COI includes policy details like your specific coverage, limits, and effective dates. While it's not the full policy, it gives you the key information you need. This helps you verify that the coverage is appropriate for the situation. It's a quick reference guide, more or less, to someone's insurance standing.

Who Needs a COI?

Many different types of businesses and individuals need a COI. For instance, contractors often need to provide a COI to clients before starting a project. This shows the client that the contractor is insured, protecting both parties. It's a common requirement, you know, in many service agreements.

Small businesses frequently need to show a COI when renting office space or equipment. Landlords or equipment providers want to know that their assets are protected. It's a way for them to make sure they are not left with the bill if something goes wrong. So, it's about shared responsibility, in a way.

Vendors working at events or on properties often need to provide a COI to the event organizer or property owner. This confirms that the vendor has adequate coverage. It's a protection measure for everyone involved, especially the main organizer. This helps keep events running smoothly, without too much worry.

Any business that engages with third-party service providers should consider requesting a COI. This includes hiring IT consultants, cleaning services, or even marketing agencies. It’s a smart business practice, really, to verify that those you work with are properly insured. It just adds an extra layer of security.

Getting a COI

Getting a COI is usually a straightforward process. You simply contact your insurance company or your insurance broker. They are the ones who can issue this document for you. It's part of their service, generally, to provide proof of your existing policies.

When you request a COI, you'll need to provide some information. This might include the name of the party requesting the COI, the reason for the request, and any specific coverage requirements. Your insurer will then generate the document based on your active policies. It's pretty quick, often, to get this done.

Sometimes, you might need a COI quickly for a new contract or project. Most insurance providers are set up to handle these requests efficiently. It's a common need, so they are prepared for it. Just be sure to ask for it with enough time, you know, to avoid any delays.

It’s a good idea to keep a copy of your COI on hand, especially if you frequently work with different clients or partners. This makes it easier to provide proof of insurance whenever it's needed. It's a small step that can save you a lot of effort later on. Learn more about on our site.

Key Details on a COI

A Certificate of Insurance includes several key pieces of information. It will list the name of the insured party, which is the person or business covered by the policy. This is very important for identification purposes. It also names the insurance company that issued the policy.

The document will also show the policy number and the types of coverage included. For example, it might list general liability, professional liability, or workers' compensation. This gives a clear picture of what kind of protection is in place. It’s a quick glance at the coverage, you know.

Limits of coverage are also clearly stated on a COI. These are the maximum amounts the insurance company will pay out for a covered claim. Knowing these limits is pretty important, as it tells you the extent of the protection. It's a key piece of information for anyone reviewing the document.

Perhaps most importantly, a COI displays the effective dates of the policy. This shows when the coverage starts and when it ends. This ensures that the policy is active and valid for the period you need it. It’s a straightforward way to confirm current coverage.

COI and Risk Mitigation

A COI plays a significant role in mitigating business risk. By confirming that a vendor or contractor has adequate coverage, you protect your own business from potential financial losses. If their actions lead to damage or injury, their insurance is there to help. It's a way to shift some of the risk, you know.

This document helps ensure that you are not solely responsible for incidents that happen due to someone else's work. It provides a layer of protection. This is especially true in industries where accidents or errors could lead to significant costs. It's a practical way to manage potential problems.

Requesting a COI isn't just about covering your own business; it's also about promoting a safer and more responsible business environment. When everyone is properly insured, it creates a more reliable network of partners. It’s a good sign of professionalism, really.

It helps confirm that an individual or business is prepared for unforeseen circumstances. This foresight can prevent disputes and costly legal battles down the line. It's a proactive step towards smoother operations. So, it's about preventing issues before they even start.

COI in Business Transactions

A COI is commonly used in various business transactions and contracts. For instance, when a business hires a new cleaning service, they might ask for a COI. This verifies that the cleaning service has liability insurance. It’s a simple check that can prevent big problems.

In construction projects, general contractors frequently require COIs from all subcontractors. This ensures that every party working on the site is covered. It's a standard practice that helps manage the overall risk of the project. It just makes things more secure for everyone.

When a business leases a new vehicle or piece of machinery, the lessor will often ask for a COI. This confirms that the lessee has insurance to cover the leased item. It protects the asset owner from damage or loss. It’s a routine part of many rental agreements.

Even for smaller agreements, like hiring a freelance photographer for an event, a COI can be requested. It provides proof of insurance coverage under specific terms. This ensures trust and helps mitigate potential issues that might arise during the event. It's about being prepared, you know, for anything.

Frequently Asked Questions About COIs

Here are some common questions people have about Certificates of Insurance:

What is the main purpose of a COI?

A COI's main purpose is to provide proof of insurance coverage. It's a document issued by an insurance company or broker that verifies the existence of an active insurance policy. It acts as a quick summary, showing that someone has valid insurance, without needing to share the entire policy document. It’s basically a snapshot of coverage details, which is very useful.

Is a COI the same as an insurance policy?

No, a COI is not the same as an insurance policy. A COI is a coverage summary issued by your insurer. It provides proof that a policy exists and outlines key details like coverage types, limits, and effective dates. The actual insurance policy is the full, detailed contract that contains all the terms, conditions, and exclusions. So, a COI is like a brief overview, while the policy is the complete agreement.

How can I get a COI?

You can get a COI by contacting your insurance company or your insurance broker. They are the ones authorized to issue this document. You'll typically need to provide some information, like the name of the party requesting the COI and the reason for the request. Most insurers can provide a COI fairly quickly once they have the necessary details. It's a standard request, so they are usually prepared for it.

Understanding what a COI is, and why it's used, can truly make a difference in your business dealings. It's a simple document, yet it carries a lot of weight in establishing trust and protecting parties involved in various agreements. It’s a testament to good business practices, more or less. link to this page .

Detail Author:

- Name : Ms. Hilda Bernhard DDS

- Username : candido32

- Email : stanton.afton@yahoo.com

- Birthdate : 1986-10-27

- Address : 24999 Flatley Valleys Apt. 758 Mylesburgh, KS 66895

- Phone : +1 (551) 342-6730

- Company : Fahey-Hayes

- Job : Insurance Underwriter

- Bio : Sint omnis non dolor omnis. Eaque magnam eaque ea reprehenderit expedita. Tempora dolor blanditiis et et.

Socials

twitter:

- url : https://twitter.com/millerb

- username : millerb

- bio : Adipisci blanditiis ex vel doloremque expedita voluptatem. Eligendi autem tenetur voluptas quia maxime saepe sit omnis.

- followers : 4158

- following : 32

facebook:

- url : https://facebook.com/brandonmiller

- username : brandonmiller

- bio : Deserunt id facere voluptates quibusdam eius consequatur aut.

- followers : 2591

- following : 2905

linkedin:

- url : https://linkedin.com/in/bmiller

- username : bmiller

- bio : Quam dolorem sed sequi dignissimos.

- followers : 5126

- following : 2878

tiktok:

- url : https://tiktok.com/@brandon_official

- username : brandon_official

- bio : Consequatur temporibus rem nesciunt. Quis est eveniet pariatur velit dolorem.

- followers : 6492

- following : 839