Thinking about insurance, or maybe even a career in it, often brings up a big name: State Farm. You might be wondering how a State Farm agent truly operates, what kind of support they get, or even what it means to become one yourself. It's a big organization, and so, there are many layers to how it all works, from helping people protect what matters to building a business of your own. This article aims to shed some light on the world of the State Farm agent, looking at things from different angles, whether you are a potential customer or someone considering a new professional direction.

For many folks, getting insurance means finding someone reliable, someone who can explain things simply. A local State Farm agent is, you know, often that first point of contact for many people seeking coverage for their cars, homes, or even their lives. They are the faces of the company in communities across the country, offering advice and helping people sort through their options. This really is about connecting people with the right kinds of protection for their lives, their families, and their belongings, which is a pretty important job.

Perhaps you have been thinking about a career change, or maybe you are just starting out, and the idea of being your own boss, yet with the backing of a well-known company, seems appealing. Becoming a State Farm agent can be a significant step, one that brings both opportunities and certain things to think about. We will explore what that might look like, from taking over an existing business to starting fresh, and what it means to be part of such a large network. It's a chance to really make a difference for people, actually, and build something lasting.

Table of Contents

- Understanding the State Farm Agent Role

- Becoming a State Farm Agent: The Career Path

- State Farm Products and Customer Experience

- Frequently Asked Questions About State Farm Agents

- Connecting with a State Farm Agent Today

Understanding the State Farm Agent Role

A State Farm agent acts as a local point of contact for insurance needs, more or less. They are there to help people get insurance quotes, explore coverage options, and just find an agent nearby. These agents really assist with a wide array of things, from car insurance to policies for your home, even life insurance. They also help people understand how to file a claim, which is, you know, a pretty important part of having insurance.

One interesting aspect about how State Farm operates is that the company generally keeps complete ownership of the client base, even if a client decides to move on from State Farm. This means that, in a way, the company always holds the rights to those relationships. It is something to consider for agents, actually, as it shapes how their business grows and operates over time. This structure is pretty common for agents who work directly for one big insurance company.

Sometimes, an agent's contract might get cancelled, and there are various reasons why this could happen. It is part of the business world, really, where performance and following guidelines are key. For example, if an agent is not meeting certain goals or if there are issues with how they are running their office, that could be a reason. It is, you know, a serious matter for everyone involved.

The role of a live agent is still very important, even in today's world where so many things happen online. While a lot of people might do quick searches or watch videos on social media, many still prefer to talk to a person when it comes to something as important as insurance. They want someone to, like, explain the details and help them make choices. So, a live State Farm agent can offer that personal touch and guidance that digital platforms just cannot quite replicate.

Becoming a State Farm Agent: The Career Path

Many people think about becoming a State Farm agent, wondering about the chances of doing well or if the products are good enough to sell. It is a big decision, and people often want advice on anything related to starting such a business. For instance, a local State Farm agent in California recently offered someone a job at his agency, and he was a new agent himself. This shows that there are pathways into this career, whether you are just starting out or looking for a change.

The company, State Farm, offers personalized insurance options, including an innovative personal price plan. With over a hundred years of being around, they provide coverage choices designed to help meet various needs. This long history and the range of offerings can make the products seem appealing to potential customers, which is, you know, a good thing for agents trying to sell them. They really do try to offer things that make sense for a lot of people.

Some people consider becoming a State Farm agent, while others think about going the independent route. The main difference is that a State Farm agent can only sell products that State Farm offers. That is what we mean by a captive agent. An independent agent, on the other hand, can sell products from many different insurance companies. This distinction is, like, pretty important for how an agent builds their business and what they can offer their clients. It changes, you know, the whole scope of things.

Considering an Agency Takeover

One way to become a State Farm agent is to take over an existing office and its client base. For example, someone might look at taking over an office with a current book of business worth about 1.8 million dollars, which could mean around $180,000 in residuals. This can be a very appealing path, as it means you start with clients already in place, so, you know, you are not building from scratch. It is a bit like inheriting a going concern.

However, there are things to think about when considering this. Some people suggest that State Farm might try to get new agents to go so deep into debt that, in a way, the company truly holds a lot of influence over them. This is something to really look into and understand before making any big commitments. It is important to, you know, be aware of all the financial aspects involved in such a venture, as it could be a pretty big investment.

The idea of acquiring an established business means you step into something that already has a rhythm. It could offer a more stable start compared to opening a brand new agency. Yet, it still means working within the State Farm system, which, like any large company, has its own ways of doing things. You will, obviously, need to learn their computer systems and how they manage quoting and closing business. Sometimes, these systems can be a bit tricky to get used to, apparently.

Working as an Agency Team Member

Many people start their journey in the insurance world by working for an existing State Farm agent. For instance, someone might have been working for an agent for two and a half years, having just finished their bachelor's degree and holding their property and casualty, life, and health licenses. This kind of experience is, you know, invaluable for learning the ropes of the business and seeing how an agency runs day to day.

There are questions about compensation for team members. For example, is State Farm team member commission 5% on property and casualty everywhere, whether in California or nationwide? This is a common query, as each agent is considered a 1099 independent contractor, working somewhat autonomously. Understanding the pay structure for team members is pretty important, especially if you are thinking about this as a stepping stone to becoming an agent yourself. It really shapes your financial outlook.

Sometimes, team members might feel they are not getting paid enough for their efforts and qualifications. With licenses and a degree, someone might feel they are worth more. This feeling is, you know, quite common in many industries. It highlights the importance of discussing compensation openly and understanding the potential for growth within an agency, or even what it takes to transition to owning your own agency. It is a conversation many people have, really.

The Captive Agent Model

As mentioned, a State Farm agent can only sell the products that State Farm offers. This is the very definition of a captive agent. It means they represent one company and its specific range of offerings. This model has its pros and cons, actually. On one hand, agents can become very knowledgeable about State Farm's specific policies and processes, which can be great for customers seeking detailed answers. They become, you know, real experts in that one area.

On the other hand, it means they cannot shop around with different insurers to find the absolute lowest price or a policy that might be a better fit from another company. Their options are, like, limited to what State Farm provides. This is a key difference when comparing it to an independent agent who has access to a wider market. So, customers looking for very specific niche coverage or the cheapest possible option might need to look beyond a captive agent, pretty much.

The captive agent model also means that the agent's success is tied directly to the competitiveness and appeal of State Farm's products. If the company introduces a new personal price plan or offers great discounts, that helps the agent. If the products are not as competitive in a certain market, that can make selling a bit harder. It is, you know, a direct relationship between the company's offerings and the agent's ability to sell, which makes sense.

State Farm Products and Customer Experience

State Farm has been around for over a century, offering a wide array of insurance options to help protect people and their belongings. They provide things like comprehensive auto insurance coverage, with information on policies, available discounts, and how to file a claim. These offerings are designed to be, you know, pretty straightforward for customers to understand and use. They really aim to make life go right for their policyholders.

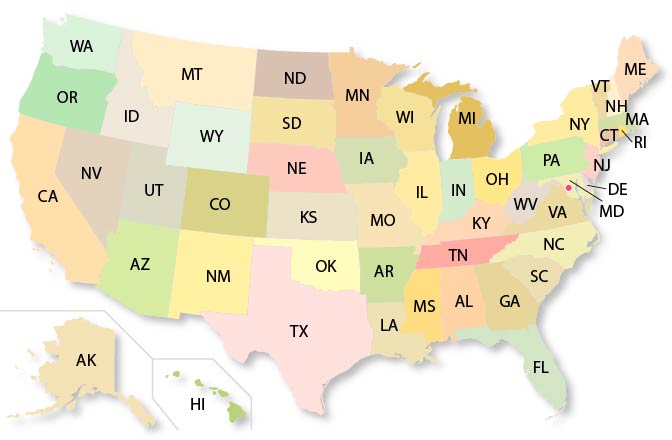

The company emphasizes personalized insurance options, including their innovative personal price plan. This suggests a focus on trying to match coverage to individual needs rather than a one-size-fits-all approach. Whatever your insurance needs, whether you are in Oklahoma, Colorado, or Massachusetts, State Farm agents are there to help. They try to be, like, very accessible in many places, which is good for people looking for local support.

Discounts and their availability can vary by state, and there are eligibility requirements that people need to meet. For example, to learn more about auto insurance coverage in your state, finding a State Farm agent is a good step. They can explain what applies where you live. It is, you know, important to remember that what works for someone in Fort Collins, Colorado, might be a little different for someone in Oklahoma City, Oklahoma, or in Massachusetts.

Getting Insurance Quotes and Finding an Agent

Finding a State Farm agent nearby to get a free quote is a simple process for many people. You can typically use their website to locate an agent in your area, whether you are in a big city or a smaller town. This makes it pretty easy to connect with someone who can help you explore coverage options and understand what might be best for you. It is, you know, a very direct way to start the conversation about insurance.

Once you connect with an agent, they can walk you through the process of getting quotes and understanding different policies. They are there to answer any questions you might have about your insurance needs. This personal interaction is often valued by customers who prefer to discuss complex topics with a real person rather than just relying on online tools. They can, like, really clarify things for you.

State Farm agents are there to help you no matter what your needs are, whether it is for your car, home, or even your business. They work to ensure you get the right kind of protection for the people and things you value most. This focus on personal service is a big part of the State Farm brand, actually, and it is something they really try to deliver on. You know, they want to be seen as helpful and approachable.

Managing Your Policy Online

For existing customers, State Farm provides ways to manage your account online. You can use your State Farm login to update your account information, pay bills, and do more. They generally walk you through each process you need to complete, making it, you know, fairly user-friendly. This digital access means you can handle many tasks without needing to call your agent every time, which is pretty convenient for a lot of people these days.

The company also considers things like security for your online interactions. For example, information might be stored on your device for things like passkeys, but it is not retained by State Farm itself. To create a passkey for your device, you would log in using your user ID and password, then visit security settings. This shows, you know, a consideration for how your personal data is handled when you interact with their digital platforms. It is something they are, like, pretty careful about.

Having these online tools complements the role of the State Farm agent. It means that while the agent is there for personalized advice and support, customers can also take care of routine tasks themselves. This combination of human interaction and digital convenience is, you know, what many modern customers look for. It offers flexibility, which is really important in today's fast-paced world.

Frequently Asked Questions About State Farm Agents

Here are some common questions people often ask about State Farm agents:

Is it possible to take over an existing State Farm agent's business?

Yes, it is possible to take over an existing State Farm agent's office and their client base. This can mean stepping into a business that already has a significant book of business, which offers a ready-made client list. It is, you know, a path many aspiring agents consider, as it can provide a quicker start than building from scratch. This option often involves a substantial investment, apparently.

What kind of products can a State Farm agent sell?

A State Farm agent can only sell products that State Farm offers. This is the characteristic of a captive agent. They provide a range of insurance options, including auto, home, life, and health policies, as well as some other financial products. They are, like, specialists in State Farm's specific offerings and services. They cannot, you know, sell policies from other insurance companies.

How does State Farm support its agents, especially new ones?

State Farm supports its agents through its established brand, training, and a range of products. New agents might get job offers from existing agencies, which provides hands-on experience. The company has a long history and offers personalized insurance options, which can help agents with their sales efforts. They also provide, you know, access to their systems for quoting and managing business, though learning them can take some time, pretty much.

Connecting with a State Farm Agent Today

Whether you are looking for insurance coverage or considering a career change, understanding the role of a State Farm agent is a good first step. These agents serve as local resources, helping people navigate their insurance needs with personalized advice. They are, you know, a key part of how State Farm connects with its customers, offering a human touch in a world that is increasingly digital. You can find out more about what they offer on the official State Farm website, for example, by visiting State Farm's official site.

If you are thinking about insurance, getting a free quote from a nearby State Farm agent is a pretty simple way to explore your options. They can discuss various coverage choices, including comprehensive auto insurance and their innovative personal price plan. Learning more about insurance policies on our site can also help you prepare for that conversation. It is, you know, all about finding the right fit for your specific situation.

For those considering a career as a State Farm agent, there are various paths, from starting as a team member to taking over an existing business. It is a commitment that involves understanding the captive agent model and the financial aspects of running an agency. You can explore more about career opportunities in the insurance field right here. It is a decision that could really shape your professional life, so, you know, doing your research is important.

Detail Author:

- Name : Dangelo Nikolaus

- Username : josefina60

- Email : delilah09@gmail.com

- Birthdate : 1974-12-05

- Address : 1653 Percival Isle Suite 904 Port Brannon, OH 15744

- Phone : (843) 730-6632

- Company : Cruickshank, Schroeder and Ebert

- Job : Proofreaders and Copy Marker

- Bio : Error fugiat et velit velit illo voluptas. Maiores fugiat rerum debitis ut in. Quos omnis dolores maxime facilis fugit ut. Illum culpa quos omnis aut optio nisi non.

Socials

tiktok:

- url : https://tiktok.com/@amie_dev

- username : amie_dev

- bio : Dicta odio accusantium voluptatem maxime cumque inventore delectus.

- followers : 918

- following : 1660

facebook:

- url : https://facebook.com/amierowe

- username : amierowe

- bio : Nihil omnis aut est alias provident animi facere.

- followers : 4014

- following : 1930

instagram:

- url : https://instagram.com/amierowe

- username : amierowe

- bio : Autem omnis odio iure. Minima praesentium sapiente dolor voluptatem.

- followers : 3767

- following : 2297

twitter:

- url : https://twitter.com/amie_dev

- username : amie_dev

- bio : Fugit atque quia et et. Esse molestiae voluptatem assumenda quaerat est enim numquam aliquid.

- followers : 6358

- following : 215